CAUTION PREVAILS IN THE LABOUR MARKET

Prague, 10 January 2023 – During the coming quarter, employers in the Czech Republic expect a flat hiring pace with a Net Employment Outlook (NEO) of 1 percentage point. Since last quarter, employers report the NEO to worsen by 11 percentage points and weaken by 15 points since a year ago. The hiring climate in the Czech Republic is ranked third to last globally, 22 points below the global average.

The Czech Republic is one of many countries close to Ukraine that are seeing a strong negative impact on jobs. Disruption and high prices in the energy sector are causing low staffing confidence, impacting the overall employment outlook. Added to this are fears of a deeper recession. These fears may conversely impact the Consumer Goods and Services sector, with price increases slowing, potentially sparking growth and more consumer confidence.

„Employers‘ nervousness is growing, but most companies are rather cautious and waiting to see how the economic and energy situation develops. Our survey shows that the number of employers who are planning layoffs in the next period has remained relatively stable for a year, however, the number of optimistic companies is significantly decreasing. Firms are suspending hiring rather than planning mass layoffs. We recorded the most optimism in IT, the public and non-profit sector, or trade and services. The opposite trend is in energy, communication services and the financial sector. However, the number of open positions on the market is still very high, so there will only be a gradual increase in unemployment,“ said Jaroslava Rezlerová, Managing Director of ManpowerGroup Czech Republic.

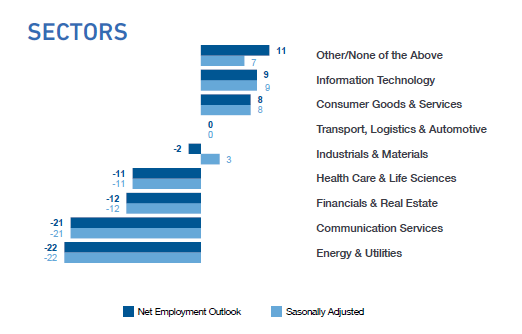

Industry sector comparisons

Employers in 4 of 9 sectors in the Czech Republic anticipate an increase in staffing levels from January to March 2023, while another 4 sectors expect a decrease, and 1 sector expects no change. Since Q4 2022, staffing climates have weakened in 7 of 8 sectors for which we have tracking data, and strengthened in one. Looking back to Q1 2022, staffing environments have weakened in 5 of 8 sectors and strengthened in three. The Czech Republic’s most competitive sector is Information Technology with an employment outlook of 9, even though expectations in the sector decreased by 10 percentage points since Q4 2022 and 23 percentage points since Q1 2022.

The most competitive sector in the Czech Republic is Wholesale and Retail Trade, with a NEO of 25. Even though expectations in the sector decreased by 3 percentage points since the previous quarter, they rose by 17 percentage points since this time last year. Indeed, Wholesale and Retail Trade is the sector to see the largest increase out of the Czech sectors since this time last year. Employers in the Primary Production sector are less optimistic, as this quarter is the lowest NEO recorded in the Primary Production sector for 7 years, going back to Q1 2015 when it was -6.

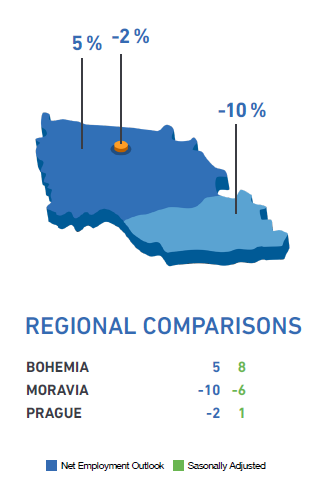

Regional comparisons

Hiring managers in 2 of 3 regions in the Czech Republic anticipate an increase in staffing levels from January to March 2023, while one region is forecasting a decrease. Since last quarter, hiring climates have weakened in 2 of 3 regions and stayed stable in one. Similarly, since this time last year, hiring environments have weakened in 2 of 3 regions and strengthened in one.

The most competitive region in the Czech Republic is the Bohemia region with a NEO of 8, remaining steady since the previous quarter, although expectations rose by 2 percentage points since this quarter last year. This steady confidence means Bohemia overtakes Prague as the most confident region in the Czech Republic. However, looking at the Moravia region, this quarter is the lowest NEO recorded for 10 years, going back to Q2 2012 when it was also -6.

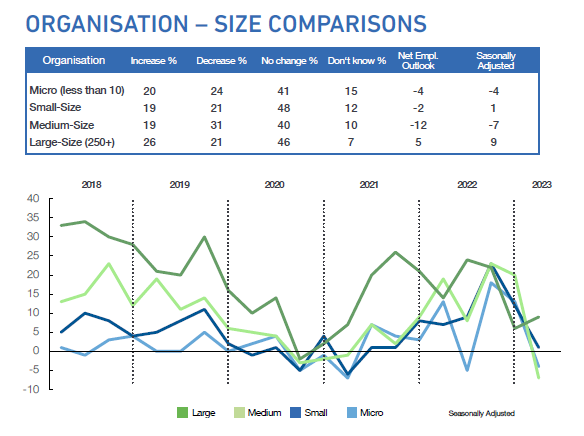

Organization Size Comparisons

Employers in 2 of 4 organization sizes anticipate an increase in staffing levels in the first quarter of 2023, while 2 organization sizes are forecasting a decrease. Since the fourth quarter of 2022, hiring environments have weakened in 3 of 4 organization sizes and strengthened in one. Looking back to Q1 2022, hiring environments have weakened in all 4 sizes of organization.

Employers in large organizations with 250+ employees are the most optimistic with a NEO of 9. These large organizations see the greatest rise in expectation, as the NEO has increased by 3 percentage points since last quarter, although falling by 9 percentage points since this quarter last year. This quarter is the lowest NEO recorded in organizations with 50-249 employees for 10 quarters, going back to Q3 2020 when it was also -7.

Global Overview

ManpowerGroup surveyed 38,951 employers in 41 countries and territories to measure hiring expectations from January to March in the first quarter of 2023. The survey was conducted while the Ukraine-Russia conflict had been ongoing for about 8 months, and some countries and territories still had pandemic-related regulations in place. Subsequent economic challenges like rising inflation and interest rates affected the hiring intentions of many employers this quarter. Yet, the demand for skilled talent continued to lift expectations, although while wages for skilled talent keep growing and inflation rises, the gap between skilled and unskilled workers is expected to widen.

Despite such obstacles, employers generally expected to increase staffing levels next quarter. Indeed, based on seasonally adjusted analysis, the Net Employment Outlook (NEO) for Q1 2023 stands at 23 points. However, global hiring intentions cooled down compared to last quarter and last year: They decreased moderately since last quarter (-6 points), falling for another quarter in a row, while employers also reported a decline compared to this time last year (-14 points). This may be because the pandemic caused extreme highs and lows, which are now beginning to balance out. Indeed, during the pandemic, many organizations over-invested in hiring and are now beginning to re-evaluate their intentions.

The strongest hiring plans for the first quarter of 2023 are reported in South and Central American markets like Panama (39) and Costa Rica (35). However, South and Central American markets also saw the sharpest drops in expectations since last quarter. For instance, Costa Rica saw a 16-percentage-point drop in hiring intentions since last quarter. Meanwhile, one of last quarter’s strongest markets, Brazil, reported a 21-percentage-point fall in expectations, now standing at a NEO of 27 points, down from 48. Although these drops may have been worsened by political tensions in the South and Central Americas, they also align with a global trend across the data. Indeed, the data for Q1 2023 showed a trend across markets, where traditionally strong markets reported the most significant declines in hiring intentions, while weaker markets saw a rise. For example, the greatest quarterly increase was reported in Greece (+9 points), which was one of the weakest markets last quarter. This data suggests that hiring intentions are starting to balance out globally.

About the Survey

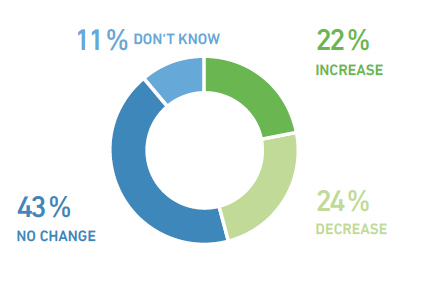

This survey is conducted quarterly to measure employers’ intentions to increase or decrease the number of employees in their workforce during the next quarter. The Czech Republic is one of 41 countries and territories participating in the quarterly measurement of employer hiring intentions. The survey for Quarter 4 2022 was conducted by interviewing a representative sample of 510 employers in the Czech Republic and asking the same question: “How do you anticipate total employment at your location to change in the three months to the end of December 2022 as compared to the current quarter?”.

More information available on www.manpowergroup.cz