CAUTIOUS SLOWDOWN IN THE CZECH LABOUR MARKET

The new year is expected to bring many changes for the Czech Republic, with upcoming local and EU elections, changes to the tax system, and a decision on the construction of the nuclear unit at Dukovany. Election results are expected to lean towards the right, following the predicted trend in many central European countries. These political and structural changes may contribute to uncertainty among employers, leading them to slow down hiring further.

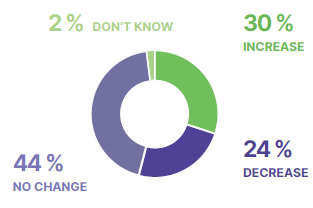

“The labour market will continue to grow moderately in Q2 2024 at a similar pace to the start of the year. There has been a slight increase in the number of employers hiring, but there has also been an increase in the number of employers cutting staff. The resulting balance is positive, but we are at a significantly lower level of optimism compared to the last two years. The Czech labour market has a relatively high inertia and negative economic changes are very slow to translate into layoffs, as companies retain existing employees even in times of a lack of orders due to the difficulty of recruitment. The most optimistic industries are Healthcare, Finance, Real Estate, Energy, IT and Communication Services. The public and not-for-profit sectors report significant declines.“ said Jaroslava Rezlerová, Managing Director of ManpowerGroup Czech Republic.

Industry sector comparisons

Czech hiring managers in 6 of 9 sectors can expect increasing the staffing climate in the upcoming quarter, while 2 sectors are predicting no change, and 1 sector is expecting a decrease. Since the first quarter of 2024, staffing environments have strengthened in 4 of 9 sectors, weakened in 4, and seen no change in 1 sector. Compared to this quarter last year, job markets have weakened in 7 of 9 sectors, strengthened in 1, and seen no change in 1 sector.

The most competitive sector in the Czech Republic is Health Care & Life Sciences with a NEO of 24. This sector reports the greatest growth in expectations from last quarter, increasing by 16 points since Q1 2024, although falling by 8 points since this time last year.

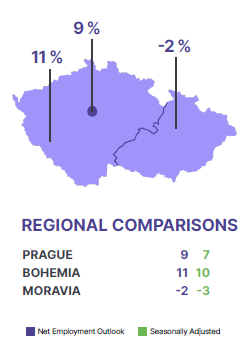

Regional comparisons

Czech employers in 2 of 3 regions expect increasing staffing levels in the second quarter of 2024, while 1 region is expecting a decrease. Since Q1 2024, hiring markets have weakened in 2 of 3 regions, and strengthened in 1 region. Looking back to this time last year, staffing environments have weakened in all 3 regions.

The most competitive region in the Czech Republic is the Bohemia region with a NEO of 10. This region is the only one to report a growth in expectations from last quarter, rising by 3 percentage points since Q1 2024. Although Bohemia’s expectations fall by 8 percentage points since this quarter last year, it reports the smallest year-on-year drop out of the Czech regions.

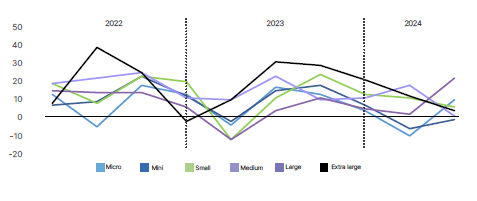

Organization Size Comparisons

Czech employers in 5 of 6 organization sizes expect increasing staffing levels in Q2 2024, while 1 organization size is predicting a decrease. Since the first quarter of 2024, hiring markets have weakened in 3 of 6 organization sizes, strengthened in 2, and seen no change in 1 organization size. Looking back to the second quarter of 2023, hiring environments have weakened in 5 of 6 organization sizes and improved in 1 size.

Czech employers in organizations in very large organizations with 1000—4999 employees are the most optimistic with a NEO of 22, rising by 20 percentage points since Q1 2024 and 18 points since the second quarter of 2023. These organizations report the greatest growth in expectations since last quarter and this time last year.

Global Overview

Going into the second quarter of 2024, employers are navigating complex challenges. On the one hand, the global economy shows a soft landing with tentative signs of recovery, as consumption, trade, and inflation are expected to normalize this year. However, resilient inflation has tempered the pace of interest rates cuts by central banks. In addition, the tense geopolitical situation with ongoing conflicts in Ukraine and the Middle East introduce uncertainty. Coupled with the large number of countries with important elections set for this year, employers are bracing themselves for a potentially volatile quarter.

Uncertainty is leading to caution, reflected in a slowdown in hiring as the labor market cools. This sentiment is captured in the Q2 2024 ManpowerGroup Employment Outlook Survey, which surveyed 40,385 employers across 42 countries and territories.

The survey highlights a decline in the global employment outlook for the second consecutive quarter, with the seasonally adjusted Net Employment Outlook (NEO) dropping from 26 to 22 points. Although there’s still demand for skilled talent, it’s at a decelerated pace compared to the previous quarter. This current employment outlook is the lowest since the sharp drop during COVID-19, but still similar to a year ago, when the NEO stood at 24.

The Information Technology (IT) sector continues to be at the forefront of hiring intentions. Companies across all sectors rely on the IT industry as they adopt AI and other new technologies. This dependence may account for IT’s continually high staffing confidence. This wave, IT sector hiring managers report a NEO of 34 points, but even the IT sector is not immune to the overall trend of reduced employment expectations. The sector sees a slight decline (-1) from last quarter and is significantly down from the COVID-19 peak in Q4 2021 when the NEO reached 61. This dip takes place amidst continued big tech layoffs in 2024.

In contrast, the Transport, Logistics & Automotive sector (16) is particularly feeling the pinch, with a sharp decline in its NEO from last quarter (-9). The sector has suffered from disruptions in shipping from geopolitical conflicts, which not only affect global trade but also contribute to price increases and further inflation, particularly impacting car manufacturers due to a limited supply of parts.

Regionally, the slowdown in hiring is a common theme, with all global regions reporting a decreasing NEO. North America (31) maintains the highest employment outlook, followed by Asia Pacific (27), as India (36) and the US (34) stand out with the most robust hiring intentions. In North America, a mix of reduced job openings and fewer workers quitting or being laid off suggests that both employers and workers are seeking stability.

More information available on www.manpowergroup.cz