CZECH EMPLOYERS EXPECT A RECOVERY IN THE LABOR MARKET

Prague, 14 June 2022 – During the coming quarter, hiring decision makers in the Czech Republic predicted a strong staffing climate with a Net Employment Outlook (NEO) of 19 percentage-points. Compared with the second quarter of 2022 workers in the Czech Republic can expect the NEO to strengthen by 8-percentage-points, and since hiring managers were asked in Q3 2021 to strengthen by 14-percentage-points. This is the highest NEO recorded in the Czech Republic since we started tracking in 2008. The NEO in the Czech Republic is ranked in the bottom half globally, -14-points below the global average.

The Czech Republic, like many of the countries neighboring Ukraine, has seen an increase in the NEO since last quarter. The influx of people, over 300,000 refugees so far, and additional manufacturing mean employers expect to hire. Additionally, confidence may be high among Czech employers as the employment rate recently exceeded pre-pandemic levels.

“The need for companies to hire new employees continues to increase and the ManpowerGroup Labour Market Index is at its highest level since the survey was launched in 2008. Recruitment optimism is seen in all sectors of the economy, but most notably in the financial sector and real estate. Continued difficulties with supply chains, rising inflation and energy prices are not having a negative impact on the labour market and unemployment has fallen to 2018 levels. However, given the great uncertainty in the economy, it is very unlikely to fall below 3%,” said Jaroslava Rezlerová, Managing Director of ManpowerGroup Czech Republic.

Industry sector comparisons

Hiring managers in 10 of 11 sectors in the Czech Republic anticipate an increase in staffing levels in Q3 2022, while 1 sector decreases. In comparison with Q2 2022, staffing climates strengthened in 8 of 11 sectors, and weakened in 3. Since the Q3 2021, the NEO strengthened in 7 of 11 sectors.

The most competitive sector in the Czech Republic is Banking, Finance, Insurance and Real Estate with a NEO of 56, increasing by 32-percentage-points since Q2 2022, and increasing by 50-percentage-points since the third quarter of 2021. This quarter is the highest NEO recorded in Banking, Finance, Insurance and Real Estate since we started tracking in 2008. This sector’s NEO is ranked third globally, beating the 40-country average quarterly increase by 18-points.

The sector with the largest increase since the second quarter of 2022 is Wholesale and Retail Trade with a change of 42-percentage-points. This quarter is the highest NEO recorded in Wholesale and Retail Trade since we started tracking in 2008. This sector’s quarterly increase is ranked first globally, beating the 40-country average quarterly increase by 39-points.

Regional comparisons

Employers in all 3 regions in the Czech Republic expect an increase in staffing levels in the next quarter. Since Q2 2022 and looking back to Q3 2021 staffing climates strengthened in all 3 regions. The most competitive region in the Czech Republic is the Prague region with a NEO of 23, rising by 2-points since the Q2 2022, and rising by 14-percentage-points since the third quarter of 2021. The region with the largest increase since last quarter is the Bohemia region up 18-points up to the NEO of 21. This quarter is the highest NEO recorded in Bohemia since we started tracking in 2008.

Organization Size Comparisons

Hiring managers in all 4 sizes of organization in the Czech Republic anticipate an increase in staffing levels from July to September 2022. Since the second quarter of 2022 hiring paces have strengthened in 3 of 4 sizes of organization and weakened in 1 size of organization. Looking back to this quarter last year hiring environments have strengthened in 3 of 4 sizes of organization.

Employers in organizations with 50-249 employees in the Czech Republic are most optimistic with a NEO of 22, rising by 13-points since the last quarter, and by 21-percentage-points since the third quarter of 2021. This quarter is the highest NEO recorded in 50-249 since we started tracking in 2008.

Global Overview

ManpowerGroup surveyed a total of 40,353 employers in 40 countries and territories to measure employer hiring intentions for the third quarter of 2022. Interviewing was carried out while effects of the COVID-19 pandemic were still prevalent. The survey findings for the July to September 2022 period are also likely to reflect the ongoing economic disruption in some countries resulting from the conflict between Ukraine and Russia, as well as from cost-of-living, inflation, and energy pressures.

Employers around the world are still expecting strong growth in payrolls. The Net Employment Outlook (NEO) for Q3 2022 is 33 points. There is a slight increase in positivity since last quarter (+4 points), although expectations have not reached the same height as the first quarter of 2022 (36 points). Based on seasonally adjusted analysis*, employers surveyed in almost all countries and territories expect to grow payrolls in the upcoming quarter.

The strongest hiring plans for the next three months are reported in Mexico (59), Brazil (54), and India (51). Employers in Greece (-1) are the only ones to expect to see a small decrease in payrolls. Employers in Taiwan (3) and Japan (4) report a low, but positive, Net Employment Outlook (NEO).

Hiring sentiment strengthens in 28 of the 40 countries and territories compared to the previous quarter. Expectations in Singapore (+15) improve for another quarter. Singapore and Guatemala (+14) show the biggest growth in expectations this quarter. Hiring sentiment weakens in 10 of the 40 countries and territories, especially in Sweden (-12) and Austria (-12). In Germany and Hungary hiring sentiment remained at 23 and 13 points respectively since last quarter. In a year-on-year comparison, the Outlook improves in 36 countries and territories but weakens in 4 (Japan, Taiwan, Greece, and Romania).

About the Survey

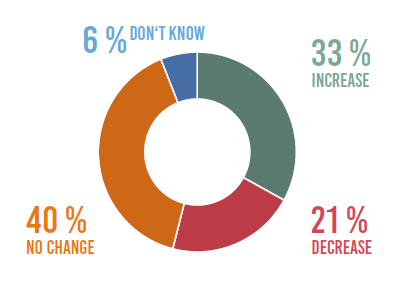

The global leader in innovative workforce solutions, ManpowerGroup releases the ManpowerGroup Employment Outlook Survey quarterly to measure employers’ intentions to increase or decrease the number of employees in their workforce during the next quarter. It is the longest running, most extensive, forward-looking employment survey in the world, polling over 59,000 employers in 44 countries and territories. The survey serves as a bellwether of labor market trends and activities and is regularly used to inform the Bank of England’s Inflation Reports, as well as a regular data source for the European Commission, informing its EU Employment Situation and Social Outlook report the Monthly Monitor.

More information available on www.manpowergroup.cz